Corporate Governance

Initiatives

We recognize that strengthening compliance is top priority for our corporate management, and the Shoko group of companies has established Corporate Conduct Guidelines and Corporate Conduct Standards that define the group’s commitment for compliance. The company provides compliance guidance through training and work sessions, and boosts awareness through education programs and practice. Executive officers and employees of SHOKO CO., LTD. and its subsidiaries are required to perform their work in compliance with laws, ordinances, regulations and Articles of Incorporation, in full recognition of their own responsibility to do so.

Corporate Governance Structure

-

Basic Policy and Systems

-

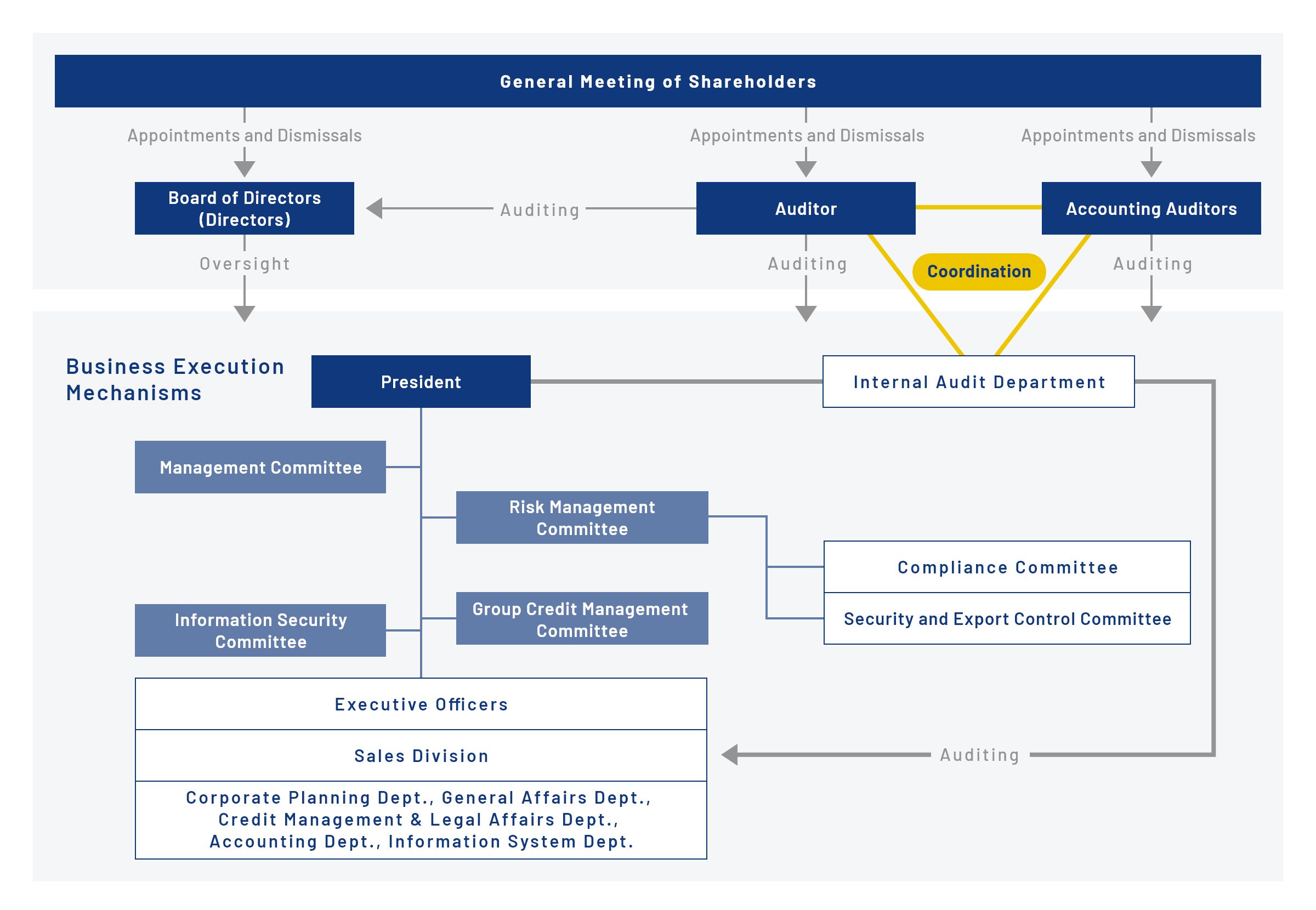

Under our executive officer system, management oversight is clearly separated from business execution.

The Board of Directors is composed of directors appointed for a term of one year. It meets once a month. It makes decisions regarding important matters and consequential proposals, as set out in management policy, corporate law, and Articles of Corporation. Its auditor system is used to audit the business execution of Directors who make up the Board of Directors, and Executive Officers (Representative Director). Auditors attend Board of Director meetings and important internal meetings, present their opinions when applicable, audit business execution, and make proposals and recommendations.

A Risk Management Committee has been established with the President serving as chair. It oversees risk issues that could seriously impact business operations. Under this committee, a Compliance Committee and a Security and Export Control Committee have been established to analyze and assess risks they are expected to manage, and respond with appropriate measures. In addition, a Group Credit Management Committee has been established with the President serving as chair. It conducts preliminary reviews of decisions made by the President and proposals made by the Board of Directors regarding transactions of the company and its subsidiaries, before those decisions and proposals are implemented.f

The internal control system shown below is designed to ensure, through enhanced corporate governance and proactive information disclosure, that the company is fulfilling its corporate responsibilities and striving to improve corporate value.

-

Internal Control Systems

-

The Basic Policy Governing Internal Control of the Company and Subsidiaries was enacted at a meeting of the Board of Directors on May 15, 2006. (Most recent amendment of part of this policy in effect since November 17, 2022) The control systems are regularly updated to maintain their applicability and effectiveness.

- A system to ensure that executive officers and employees of SHOKO CO., LTD. and its subsidiaries comply with laws, ordinances, regulations and Articles of Incorporation

- A system to manage the storage of information regarding the company’s executive officers roles and the execution of their duties

- A system of rules and regulations governing management of a crisis event causing loss or damage to the company or its subsidiaries

- A system to ensure that the executive officers of the company and its subsidiaries execute their functions effectively

- A system to ensure that the business group comprised of the company and its subsidiaries performs its functions appropriately

- A system promoting employee collaboration with company auditors

- A system that facilitates reports to directors, employees and others of the company and its subsidiaries

- A system that ensures that a whistleblower who submits a report to the company’s auditors is not treated negatively for having done so

- A system that ensures that audits by the company’s auditors are conducted effectively

Compliance

-

Basic Policy and Systems

-

Transparency and sound management increase our corporate value, and this, we believe, leads to greater shareholder trust and approval. We have strengthened our corporate governance and risk management systems, are promoting the sale of products and materials that have global environmental conservation as a goal, and are building a corporate base for sustainable growth and development.

-

Fundamental Commitment to Compliance

-

Shoko’s Three Compliance Principles

- We know that a compliance gap could threaten our corporate base, and rank full compliance as a basic management principle.

- Through full compliance, we provide products and services that answer customer expectations for safety and functionality, leading to being trusted and viewed favorably by shareholders and markets.

- We fully consider the environmental, social and economic aspects of our business activities, guided by a spirit of fairness and sincerity while contributing to efforts to make a better world, for sustainable growth and development.

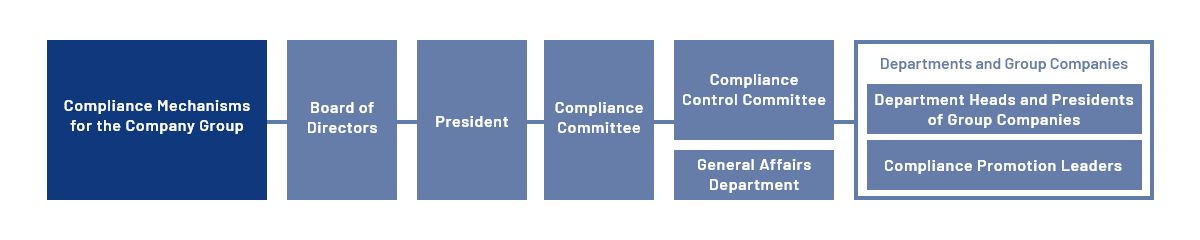

Compliance Mechanisms for the Company Group

The Shoko group of companies has drawn up the following mechanisms to promote adherence to Shoko’s Three Compliance Principles.

All executive officers and employees are expected to fully grasp these mechanisms and put them in practice in our daily business.

-

Line of authority regarding compliance

With authority vested first in the Board of Directors, followed by the company president and then the Compliance Committee, each of these has their respective authority and responsibility to make decisions on compliance-related matters and exert managerial control over compliance status.

-

General Affairs Department (Compliance Committee Secretariat)

This department has overall supervisory powers over compliance, planning and promoting actual practice. It plans and implements compliance training and education programs, etc.

-

Department heads and group company presidents

As officers responsible for compliance, we department heads and group company presidents strive to ensure compliance within their respective department or company, and appoint compliance promotion leaders.

-

Compliance promotion leaders

These leaders assist department heads and group company presidents in the promotion of compliance, and, as part of their function, perform the following actions.

- Organize educational programs and provide compliance guidance for employees in their department or group company

- Address and correct any compliance-related ambiguities at the department or group company level

- Respond appropriately to compliance-related reports and inquiries from department or group company employees

- Report compliance-related matters involving their department or group company to the Compliance Committee

- In accordance with instructions from their department head or group company president, implement compliance measures at their department or group company

-

Establishment of an Internal Whistleblower Contact Line and Help Desk

-

We have established a Compliance Help Line for reports from individuals who learn of a compliance gap.

Personnel are made aware of this system through in-company training sessions and other opportunities, and are encouraged to use it when appropriate, thereby supporting prompt discovery of compliance gaps and remedial efforts.

Risk Management

-

Basic Policy and Systems

-

Management meetings are held monthly to examine significant projects and proposals from multiple perspectives, closely examining level of strategic importance, risk and its extent, outcomes, etc. For risks that could impact the group as a whole, a Risk Management Committee is established with the company president as chair, and under this committee are established a Compliance Committee and a Security and Export Control Committee. Risks pertinent to each committee are analyzed and assessed, and appropriate measures are taken. In addition, a Group Credit Management Committee headed by the company president conducts a preliminary review of decisions made by the President and proposals made by the Board of Director regarding transactions of the company and its subsidiaries, before those decisions and proposals are implemented.

If any of the 18 categories of business risk or some equivalent risk becomes apparent and countermeasures are required to deal with this urgency, a Crisis Response Headquarters is established with the company president serving as chair. If some urgent matter arises, the company will immediately request advice from experts and take steps to accurately ascertain the crisis and take remedial action.Various Action Committees

Committee Purpose and Outline Risk Management Committee Prioritizes risks and determines risk management policy; implements measures based on the risk management policy; monitors the status of measures; improves measures Compliance Committee Ensures compliance and strict adherence to legislation and regulations Security and Export Control Committee Exerts strong risk management over transactions with other countries; enhances control systems, to ensure compliance with trade laws and prevent fraudulent exports Group Credit Management Committee Conducts a preliminary review of decisions made by the President and proposals made by the Board of Director regarding transactions of the company and its subsidiaries, before those decisions and proposals are implemented Information Security Committee Determination of information security measures, operation and improvement of Shoko Group, prevention and countermeasures of information security incidents Safety and Health Committee Raise awareness among employees about health and enhance safety and health managerial activities to create a vivid workplace

-

Information Security

-

We rank information security as an important management and business issue. For fundamental issues, the company has adopted an Information Security Policy that calls for protecting the corporate group’s information assets from security risk. The policy is revised as necessary, to respond flexibly to the development of new risks and technologies.